Marriott's plan shows that the hotel giant is continuing its expansion, especially in Asia, including Vietnam; aiming to maintain its leading position in the hotel and resort sector globally.

Target of 1.8 million rooms by the end of 2025

After a positive second quarter of 2024, Marriott's leaders still forecast that RevPAR (Revenue per Available Room) will narrow the growth range for the whole year of 2024, mainly less optimistic in the Chinese market, along with expectations of a slight decrease in the US and Canada due to the impact of the US Presidential election.

CFO Leeny Oberg said that fee revenue in the third quarter will increase by about 6-8% and the whole year will increase by 6-7%. Global RevPAR in the third quarter as well as the whole year will increase by 3-4% compared to the same period. The number of net rooms for the whole year is expected to increase by 5.5-6%. Revenue from fees in the third quarter is expected to be between $1.27-1.29 billion. The full year will reach more than $5 billion.

In a meeting with stock analysts in September 2023, the Group's leaders said that they are prioritizing the growth of the number of hotel rooms globally in the long term. Marriott focuses especially on high-end products and resort tourism. Brand conversion deals, especially the conversion of many hotels at the same time, are also an important part of Marriott's overall growth strategy.

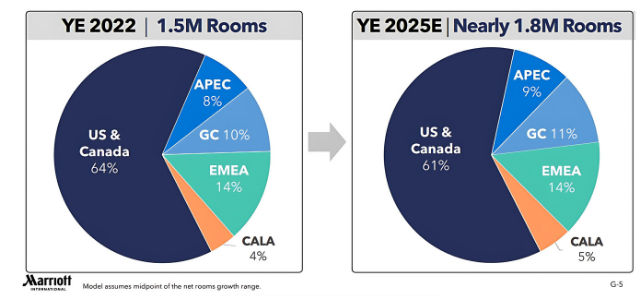

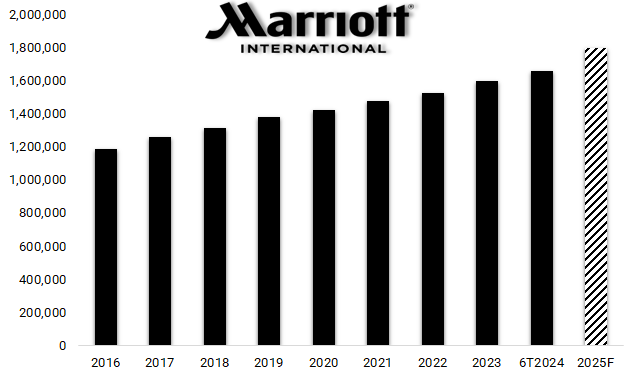

The Group plans to add 230,000-270,000 rooms in the next 3 years, thereby expanding the global hotel portfolio to 1.8 million rooms by the end of 2025 and continuing to lead the industry. The average growth rate of the number of rooms is estimated at 5-5.5%/year. Marriott's model forecasts global RevPAR to grow by an average of 3-6% per year in 2023-2025.

According to the scenario, total fee revenue will reach around USD 5.4-5.8 billion in 2025, equivalent to an average increase of 6.5-9.5% per year in 2024-2025. The contribution of fees from the US and Canada is likely to decrease from 59% to 54%; in return, the international region will increase from 22% to 27% thanks to "expansion" to APEC and China.

Marriott's hotel structure by region forecasts to 2025 with an average growth rate of 5-5.5% per year. APEC: Asia-Pacific; GC: China; EMEA: Europe, the Middle East and Africa; CALA: Caribbean and Latin America. Source: Marriott

Marriott's room count from 2016 and forecast to 2025 (Unit: room)

Source: Compiled by the writer

Unprecedented expansion plan in Vietnam

After changing the brand from InterContinental (of rival IHG Hotel Group) to JW Marriott Hotel & Suites Saigon, Marriott now manages one of the most primely located hotels in Ho Chi Minh City; at the same time, bringing the number of hotels and resorts operating in Vietnam to 24.

Last October, Marriott announced the signing of an agreement with Bitexco and Sun Group to open three new luxury resorts and Vietnam's third JW Marriott hotel in Trang An.

"Vietnam is a growing market for luxury travel, with growing demand from both international and domestic markets," said Rajeev Menon, President of APEC, at the signing ceremony, adding that these contracts underscore Marriott's commitment to the future of the hospitality industry in Vietnam.

In the middle of last year, the company's leaders used the word "victory" to talk about the agreement to convert 7 more hotels and resorts with Vinpearl, bringing the total number of hotels in cooperation with the Vietnamese tourism real estate developer to 15 in the 2022-2023 period. Of which, 9 hotels and resorts have been completed; 2 new locations are expected to open in 2025, including Sheraton Vinh and Four Points by Sheraton Ha Giang; 4 other projects with more than 1,200 rooms will be put into use in 2028, including Marriott Bac Ninh.

Perspective of JW Marriott Trang An Resort & Spa. Source: Marriott

According to CEO Anthony Capuano, conversions are an important part of the Group's growth story, especially in the context of a somewhat limited market for new construction debt. "In some APEC countries, which have historically had disproportionate new construction, we are seeing some conversions increase. The pursuit of conversion opportunities is quite prudent and it leads to transactions like the one I mentioned earlier in Vietnam," he said.

In addition to hotels and resorts, Marriott also "attaches" its famous brands to the apartment segment, including The Ritz-Carlton Residences, Hanoi; Marriott Residences Grand Marina, Ho Chi Minh City; JW Marriott Residences Grand Marina Saigon; The Residences at Arbora, a Luxury Collection Resort & Spa, Quang Nam, Da Nang.

“The APEC region is one of the fastest growing regions in the world for branded residences, driven in part by significant growth in Vietnam, where the Company expects to open several Marriott-branded properties over the next four years,” the company said in a report in April 2022. Back then, with just 10 hotels and resorts, the Group announced plans to quadruple its portfolio in Vietnam with signed agreements to nearly 40 hotels, expected to add nearly 9,000 rooms.

During his visit and meeting with Prime Minister Pham Minh Chinh in October 2023, Marriott CEO continued to appreciate Vietnam's potential and advantages for tourism development. He said Marriott will open 20 more hotels and resorts in major cities such as Hanoi, Ho Chi Minh City, Da Nang, Phu Quoc, etc.

Source: https://fili.vn/2024/10/marriott-dang-co-ke-hoach-gi-tai-viet-nam-ky-2-737-1234638.htm